Credit card and student loan debt in the United States are both at an all-time high as of 2018. And what’s even worse is that the Federal Reserve is indicating that “interest rates will increase” over 2018. 11% of consumers are already more than 90-days “past due” on monthly payments, and once interest rates increase, so will monthly payments. We are experiencing a debt crisis, and Americans are struggling to find the right path to stay afloat.

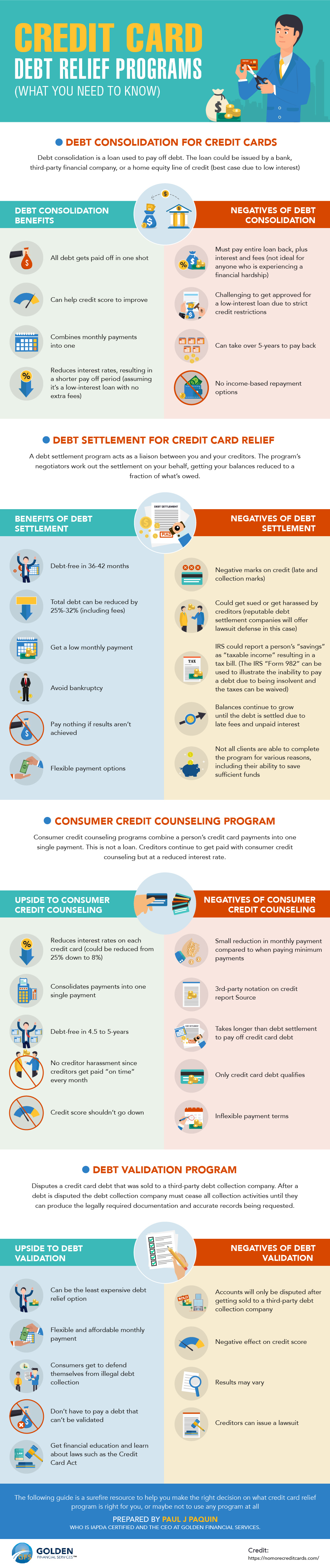

Here are 5 options that are guaranteed to work and included — is an INFOGRAPHIC that highlights the PROS & CONS of each debt relief option — a surefire guide to keep you safe from falling into the wrong path.

1. Federal student loan consolidation

To consolidate your federal student loan debts, simply go to StudentLoans.gov, where government programs are available.

If your income was reduced, you can qualify for an income-driven repayment plan where your new monthly payment can be close to zero dollars per month.

Once you arrive at the site, click on the tab that says “repayment and consolidation”. From there, just follow the easy instructions. You will be asked to enter your income and family size, and these two items are what determine your new monthly payment.

After entering your income and family size, you will then be presented with 7-8 options. Pick the plan that offers the lowest payment and maximum amount of loan forgiveness. Every year you must come back to this site to recertify, where you need to update the federal government on your income and family size, and it’s that easy! If you forget to recertify, you will be kicked out of the program and back deep in debt!

If you work in a public service job, you will be able to have your entire balance forgiven after only making 10 years worth of payments. Stay in good communication with the loan servicer who takes over your new consolidated loan, and they will advise you on what to do each step of the way. You can call your loan servicer whenever you have a question, make sure that they answer your questions accordingly, so that way you can hold them to be accountable if they mislead you.

2. Consumer Credit Counseling

A consumer credit counseling company negotiates with each of your creditors to reduce the interest rates, but only credit card debt qualifies. If your goal is to combine all of your credit card payments into one payment and lower the interest rates, consumer credit counseling will be your answer.

Your payment stays around the same as when paying only minimum payments on your own, but since interest rates get reduced — you get out of debt faster.

If you need credit card relief, consumer credit counseling is the first option that you want to explore.

3. Debt Settlement

If you are behind on monthly payments and your accounts are already being sold to a debt collection company, debt settlement services can settle these debts so that you only have to pay around half of what you owe, plus the debt settlement company’s fee. Only join a debt settlement program that comes with an attorney and FDCPA defense.

The FDCPA defense is when creditors violate your consumer rights, which is common, the FDCPA defense is used to take legal action against them for violating the laws. This will lead to a portion of your debt getting dismissed and when a debt is dismissed it comes completely off your credit report. When a debt comes off your credit report, your credit score will improve.

Debt settlement will leave negative marks on your credit report, so it’s best to join a reputable credit repair program after finishing the debt settlement service, as credit repair services can often dispute and get negative marks removed from your credit. The key is to “find a reputable” credit repair service, one that has a proven track record of success and no complaints. Just plan to join a credit repair service after finishing the debt settlement program.

The most important step to take before joining a debt settlement program is to:

Check the debt settlement company at the Better Business Bureau. Make sure they have several years in business, an A+ rating and no customer complaints.

4. Your 3 Best Debt Consolidation Loan Options

Bank loan:

Debt consolidation is a loan that is used to pay off any type of debt that you have. You do need a high credit score to qualify for a debt consolidation loan at the bank, so these loans are difficult to come by.

Only get a debt consolidation loan if the interest rate is smaller than the “average interest rate” on your other debts, and make sure that the monthly payment is affordable.

A home equity line of credit:

You can even use a home equity line of credit as a debt consolidation loan, as they come with the lowest interest rate.

401(k) loan to pay off debt:

A third way of consolidating debt is by using your 401(k). When you pay back this type of loan you are paying interest to your own 401(k), so in reality, you are paying “no interest”!

5. Try to get out of debt on your own, without a debt relief program.

Before exploring debt relief programs, first, create a budget analysis. A budget analysis allows you to figure out all of your expenses and see what you can truly afford to pay each month. On Mint.com you can get a free budget analysis template. https://www.mint.com/budgeting-3/keep-track-of-your-finances-with-a-free-budget-template

If you can afford to pay more than the minimum monthly payment on your creditors, skip a debt relief program altogether, and work towards eliminating your debt on your own.

The key is to — Attack one account at a time, while paying minimum payments on the others.

Use the budget analysis to help you find expenses that you can eliminate from your life, and that will give you extra money that can be used to aggressively attack the one account that is hurting you the most. When I say “hurting you the most” I am referring to “your most expensive debts”. Which debt has the highest payment and highest interest rate?

That is the debt that you want to start attacking and meanwhile just paying minimum payments on all of your other debts. Once you get that big problem debt resolved, then you can start attacking another debt, and one by one you can become debt free. But it all starts with making a budget, and then from there, you will have a visual of what you can afford and can come up with a game-plan.

6. Bankruptcy

Chapter 7 bankruptcy can erase your debt faster than any other program, but years later when you need your credit to purchase a new car, rent or buy a house or even get a loan, bankruptcy will get you denied for all of it. Creditors look down upon bankruptcy, worse than they do on any other type of notation that could be on your credit report.

If you need bankruptcy to give you fast debt relief, and don’t care if your credit is trashed for the next seven years, Ok then consider bankruptcy. Bankruptcy will deal with the debt problem, but will also create new problems for your credit report, so that’s the catch that you need to beware of when considering bankruptcy.

By Paul Paquin

Paul J Paquin is the CEO at Golden Financial Services and an IAPDA Certified Debt Relief Expert. Paul Paquin is also the Author of “Debt Consolidation to Pay Off Credit Card Debt”. Golden Financial Services offers debt relief programs in 38 states, just last month opening Alabama debt relief offices.