If you don’t pay your credit card when the bill arrives, your credit score will take a beating. Month after month, the beatdown will continue to get worse and worse, and your debt will continue to grow due to late fees and unpaid interest. Devastating scars will be left on your credit report for years to come.

So the last thing you want to do is to stop paying your credit cards for the purpose of using this debt relief option that we are about to reveal, but if you have a legitimate financial hardship and can’t afford to pay your credit card — here’s how to resolve the debt without paying and get it off your credit!

Who will benefit from today’s lesson?

If you can’t afford to make minimum payments on your credit cards or have already fallen behind on the monthly payments, you could benefit from today’s lesson.

Debt Validation – your legal right to dispute a debt

If you stop paying on your credit card, within 4-6 months it will get written-off and sold to a debt collection company.

When a credit card company writes-off a debt, this allows them to clear the debt from their records, essentially getting reimbursed through tax refunds by showing their loss.

Here’s where the banks get careless … After writing-off a debt off, now the banks want to make additional profit, so they sell your account to a debt collection company for pennies on the dollar — dirt cheap!

The bank doesn’t transfer all of the legally required documentation that debt collection companies need to have to collect on the debt, and information becomes inaccurate and flawed. In 90 out of 100 cases, debt collection companies will get paid by using scare tactics, but if you’re the smart 10% that actually challenges the debt collection company before paying the alleged debt, well — you will most likely obtain the victory and escape the debt without paying and without blemishing your credit.

Debt validation is your answer. Debt validation is your legal right that allows you to dispute a debt, forcing the debt collection company to prove it’s validity. This is the fastest method of resolving a debt and getting it off your credit report, as debt collection companies quickly agree to stop collection on the debt to avoid getting exposed.

To use debt validation, you must submit everything in writing to the debt collection company, this is not something you can do over the phone, it all needs to be in writing.

You can use the following laws to dispute a debt:

1. The Credit Card Act of 2009

2. The Truth in Lending Act (TILA)

3. The Fair Debt Collection Practices Act

4. The Fair Credit Reporting Act

5. The Federal Fair Credit Billing Act

How to use debt validation to dispute your debt

Send a letter to the debt collection company requesting:

A. Their debt collector’s license to collect on a debt in your state.

B. Request for the following details from the debt collection company:

- When the statute of limitations will be reached on the debt and how they came up with that date?

- When the account was opened and with whom the account was opened? (must supply original creditor name and information)

- The debt collection company’s legal name and address?

- Do you as the Debt Collector have a bona fide affidavit of assignment for entering into the purported contract between the original Creditor and Debtor?

- Was the verification cited executed in the form of a sworn or affirmed oath, affidavit, or deposition?

- Who did they purchase this debt from, for what amount and on what date was the debt purchased?

*Also request the debt collection company provide you with;

- Your name and address.

- The amount they say you owe, how they came up with that amount and the full account number on the account.

If they can’t provide all of the accurate answers and documentation to backup their answers, they CANNOT continue coming after you for the debt and CANNOT legally continue reporting the debt on your credit report.

C. Request the original contract that you supposedly signed with the original creditor that sold them the debt.

D. Provide you with the requisite verification of the debt as required by the Fair Debt Collection Practices Act, and other consumer protection laws.

Whenever you discuss the debt, refer to it as: “the alleged debt”, and never as “my debt”. You don’t want to admit to the debt.

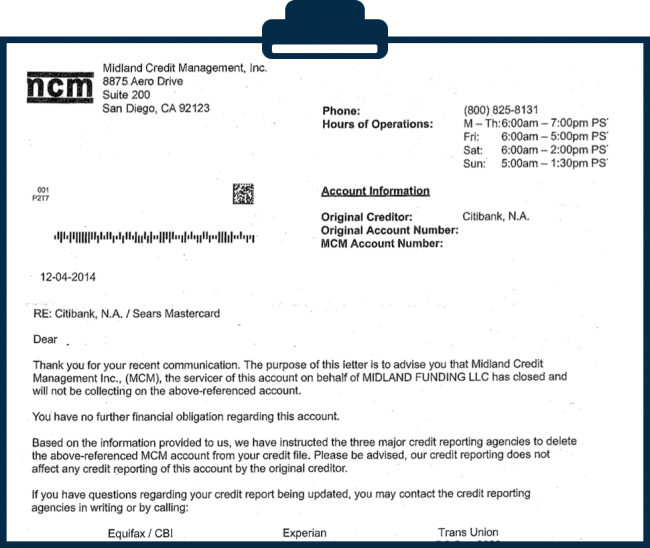

If the debt collection company can’t provide you all of the accurate details and complete records, they will quickly send you a letter in response to your debt validation request where they agree to stop collection on the debt and remove it from your credit report, as shown in the example letter here:

By Paul Paquin

IAPDA & AFSLR Certified Debt Relief Expert, Paul J Paquin — unleashes tricks and tips on how to get out of debt fast and repair credit, from his 15 years experience as CEO at Golden Financial Services, a national debt relief company. Paul is also the author of the book called “Debt Consolidation to Pay off Credit Card Debt”, found on Amazon.