There are many traders in forex who do not know that spread is an important part of their profit making. The spread is the amount of money that your broker charges form you every time you place your trade on the market. This is the money that you pay for the trades because the broker does not know if you will have any money in your account after the trade. This market is volatile and all the traders are trying to make a profit but only a few are successful. The spread works like a barrier to your profit if the spread is high, you will have a hard time in getting the money because you will need a more favorable trend in your position and if the spread is low, and you can make profit easily. This article will give you a brief idea of the spread and why this small amount of money can have a significant impact on your career. Traders think it does not matter the money they are giving to the brokers but this small amount can empty your account if the spread is high.

Those who are comparatively new in the retail trading community should always trade the market with fixed spread broker. Most of the time, the spread becomes extremely big prior to the high impact news release. In such case, many novice day traders have to face huge loss since they forget to recalculate the spread of the market. You have to think about the complex nature of the market or else you will never become a profitable trader. Being a new investor you have to understand the fact, taking too much risk in any single trade will result in a huge loss. You have to follow the conservative way of trading or it will be really hard to establish your presence in the professional trading network.

The moment you start trading the market is the very moment you start taking challenges in the retail trading community. CFD trading in Australia is very easy to provide that you know how to manage your risk. Always try to protect your investment and play safely in the market.

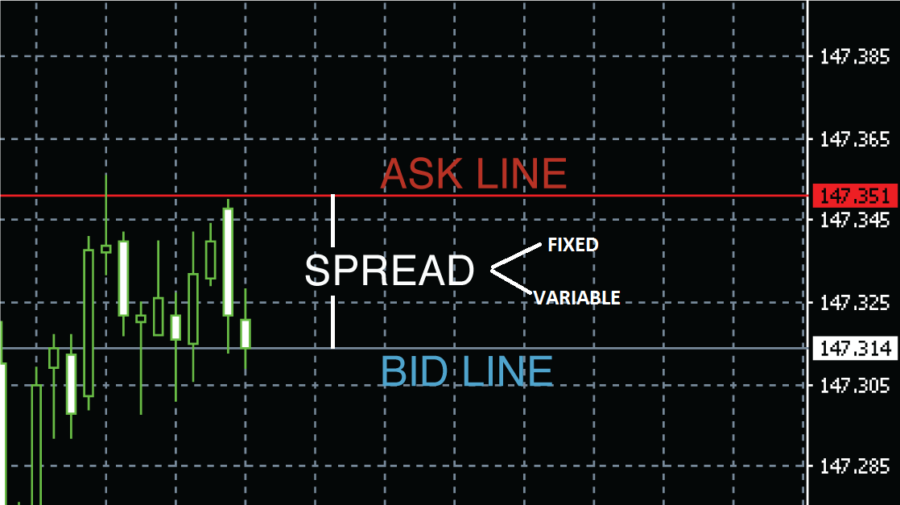

Variable Spread and the Fixed Spread

Do you know that there are two types of spreads I this industry? We know that most of the people had no idea what these two spreads are but we are going to tell you. One is the variable spread and the other is the fixed spread. Whenever we talk about the spread, we do not mention any of them and people always think there is only one spread. There are two spreads and the variable spread changes with the market volatility. Most brokers would charge you 1 to 4 pips in normal market conditions in the variable spread but in volatility, the variable spread can be 8 to 10 pips. If you trade with the fixed spread, you do not have to worry about the changing amount. This market is always fixed in every market volatility. If your broker offers you fixed trade and it is 4 pips, it will always be 4 pips in all market conditions.

Which Spread is Best for Me?

There is a long debate on the intimacy of these two spreads among the traders. One group think the variable spread is the best for them as it changes with the market trends, they can adjust their strategy to the risks and volatility. Another group thinks the variable spread poses threats to the accounts. Traders will have to always readjust their strategy to focus on the spread as it will change over time. If they trade with the fixed spread, they can focus on the market without thinking of spread. In all volatilities, the spread will be same. It is up to you to decide what would you like.